Nelson Capital Management

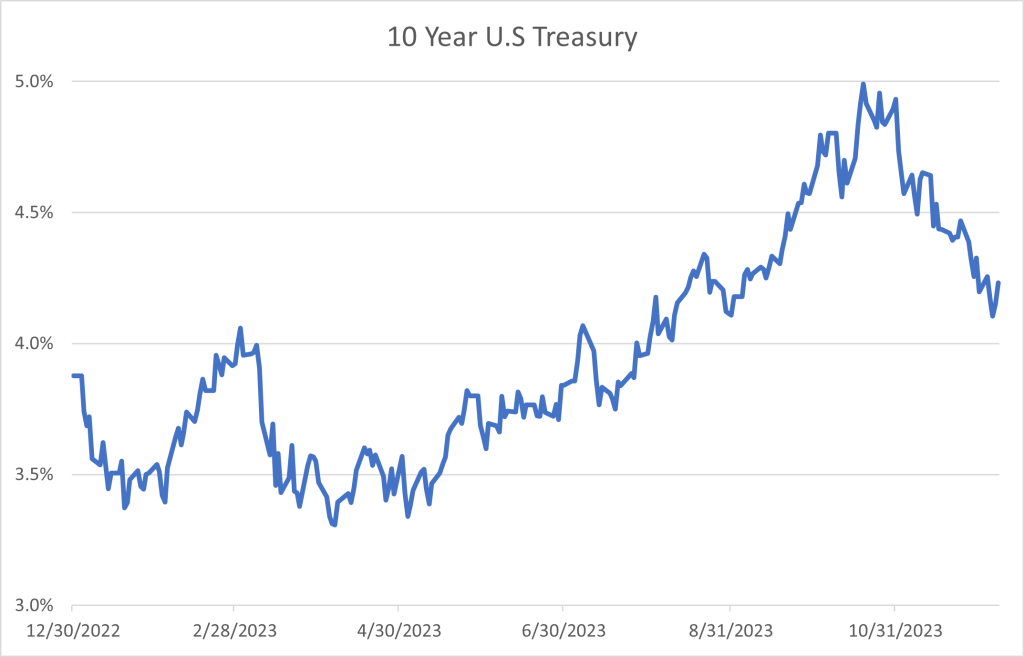

When the Covid-19 pandemic hit the U.S. economy in March 2020, the Federal Reserve acted quickly to cut interest rates to stimulate the economy. By August 2020, the yield on the 10-year Treasury had fallen to 0.50%. As the economy rebounded and inflation spiked, the Fed reversed course and began raising interest rates in March 2022 until they paused in September 2023. This current period of rate hikes has been one of the most aggressive tightening cycles in history and has lifted rates across the yield curve.

The dramatic repricing of the bond market has made bonds more attractive than they have been in over a decade. But investors must grapple with several considerations when buying fixed income, including duration risk. Should you buy a 1-year, 5-year or 10-year maturity? And how does an inverted yield curve impact that decision?

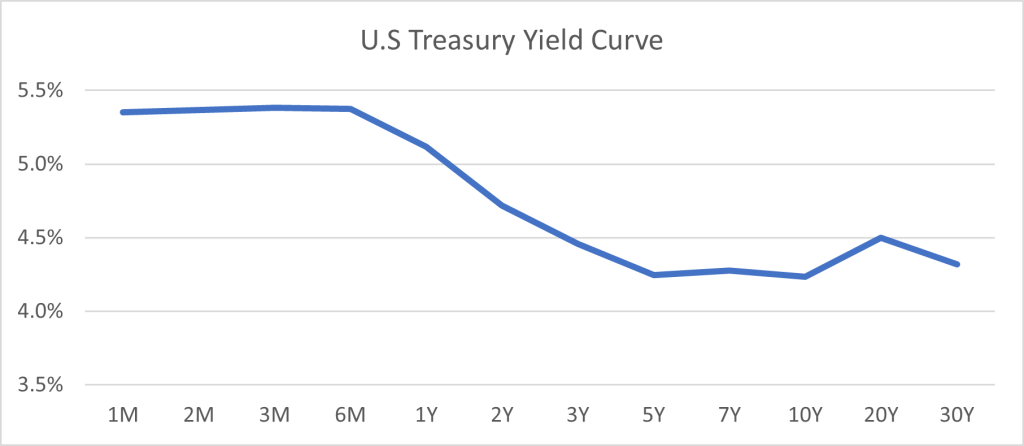

The Treasury yield curve is usually upward-sloping, meaning longer-term securities yield more than shorter-term securities. This makes sense, as investors typically demand higher yields in exchange for locking their money up for a longer period. However, this is not the case today. Over the past year and a half, the yield curve has been inverted, which means that there is no yield incentive for investors to venture out into longer bond maturities. Investors can earn better yields on the short end of the curve without incurring any interest rate risk. But the decision to buy short-term bonds can have consequences. While short-term yields are currently higher, they are also more sensitive to Fed policy, which means these yields will fall when the Fed starts to cut rates.

Why would an investor buy a 10-year bond when it is yielding less than a 1-year bond?

The answer is re-investment risk. Higher short-term interest rates may seem attractive, but reinvesting at similar yields upon maturity may be impossible if interest rates fall. Reinvestment risk is often of greater concern when the yield curve is inverted, and short-term rates are expected to fall. For example, if an investor bought a three-month Treasury Bill with a yield of 5%, they would benefit from that annualized yield until the maturity date. But if interest rates drop to 4.0%, they would be forced to reinvest at a lower rate after three months. It can be tempting to invest in the highest yielding bond, but market interest rates can quickly reverse course, amplifying the impact of reinvestment risk. Longer Treasuries maturing in 10 years or more have historically outperformed shorter-dated Treasuries immediately following the period when the Fed has completed its tightening cycle.

Going Forward

Bonds are an important asset class for investors who are looking to generate income and lower overall portfolio risk. The best time to own bonds is at the top of an economic cycle when interest rates are likely to move lower. It is uncertain at this point whether the Fed is officially done raising rates, but we believe we are closer to that inflection point with economic indicators showing the economy slowing and inflation abating. The recent increase in longer-term yields presents a good opportunity to extend bond duration in portfolios and lock in current yields for a longer period. If inflation picks back up and rates increase, today’s bond coupons and higher interest payments will help offset price declines—a benefit investors did not have when rates were much lower.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Capital Management, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.