Nelson Capital Management

Earlier this year, we initiated a position in iShares Cybersecurity and Tech ETF (tkr: IHAK). Demand for cybersecurity has skyrocketed over the past decade and will continue to rise as the frequency, sophistication and impact of cyberattacks escalate. Fortune Business Insights estimates the global cybersecurity market will grow from $193.73 billion in 2024 to $562.72 billion by 2032, exhibiting a CAGR of 14.3% during the forecast period.

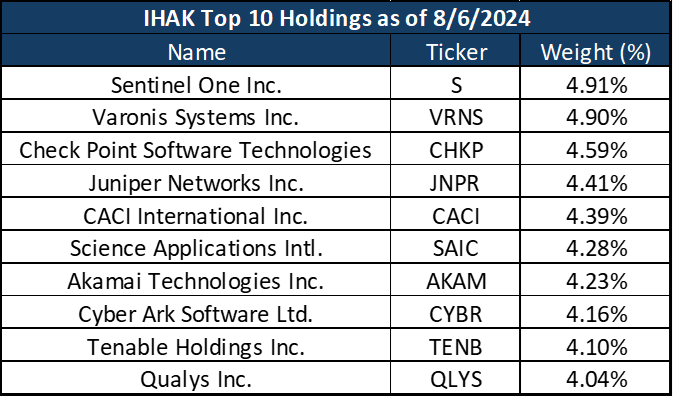

The cybersecurity market is robust with several companies offering solutions for various aspects of cybersecurity. As a result, the market is highly fragmented, leaving opportunities for consolidation within the industry. For example, Sentinel One (ticker: S) is notorious for its endpoint security solutions, securing a network’s servers, desktops, laptops and mobile devices from malicious activity, but it is expanding to include solutions for cloud security and more. Check Point Software Technologies (ticker: CHKP) is better known for its network security solutions, including firewalls, but it is also growing its cloud security solutions. Investing in an ETF rather than an individual cybersecurity company offers a balanced way to invest in the industry. We want exposure to providers of multiple types of cybersecurity.

The cybersecurity market is robust with several companies offering solutions for various aspects of cybersecurity. As a result, the market is highly fragmented, leaving opportunities for consolidation within the industry. For example, Sentinel One (ticker: S) is notorious for its endpoint security solutions, securing a network’s servers, desktops, laptops and mobile devices from malicious activity, but it is expanding to include solutions for cloud security and more. Check Point Software Technologies (ticker: CHKP) is better known for its network security solutions, including firewalls, but it is also growing its cloud security solutions. Investing in an ETF rather than an individual cybersecurity company offers a balanced way to invest in the industry. We want exposure to providers of multiple types of cybersecurity.

IHAK is more diversified than its peers with a total of 40 holdings, three quarters of which are based in the U.S. with the rest in Israel, Japan and other countries. While 85% of the fund’s assets are information technology stocks, the remaining 15% fall within the industrials sector. It has roughly $520 million in assets under management and an expense ratio of 0.47%.

There are several key drivers of demand for cybersecurity. First, our society is undergoing a digital transformation as companies integrate digital technology into all aspects of businesses to improve efficiencies and increase customer satisfaction. Many companies are moving their IT infrastructure from an on-premises network to a hybrid or cloud environment as it is often more secure and cost-efficient. The latest phenomenon in digital transformation is the utilization of artificial intelligence. Similarly, the acceleration of the Internet of Things (IoT) has connected more devices to the internet, including things like cars and household appliances. With more connected devices comes more vulnerabilities and opportunities for potential cyberattacks.

Next, regulatory bodies are implementing more stringent cybersecurity and data protection laws to ensure consumer data is protected. This is especially true for financial services companies that deal with individuals’ sensitive information like social security numbers. Failure to comply with these requirements could result in reputational loss, hefty fines, and other legal consequences.

Finally, we are seeing a rising economic impact from cyberattacks from ransomware payments as companies cave in and pay off hackers. Companies also face severe operational disruption from these attacks. An IBM report cites the global average cost of a data breach in 2024 was $4.88 million, up 10% from a year prior to a new record. Often, there is a cascading impact from the los operations that trickles all the way down to end users, which implies the impact may be even greater.

Recent incidents of cyberattacks reinforce the importance of cybersecurity. In June, a ransomware attack on CDK Global left thousands of car dealerships without their key software platform used to manage everything from scheduling to sales and orders, for weeks. The company is estimated to have paid a $25 million ransom in Bitcoin to regain access to its data. Anderson Economic Group estimate dealer financial losses from the CDK cyberattack were over $1 billion, including the loss of ~56,200 new vehicle sales in the three weeks following the attack. This served as another wake-up call emphasizing how crucial it is to have a sophisticated cybersecurity ecosystem and the vast impact that a breach can have.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Capital Management, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.