Nelson Capital Management

The U.S. economy relies heavily on a well-functioning bond market. When the bond market experiences disruptions or liquidity issues the economy begins to sputter. On April 2, 2025, the Trump administration unveiled a set of tariffs on imports into the U.S., and even higher tariffs on goods from about 60 countries that have a large trade deficit. While markets had been bracing for the tariff announcement, the scale and scope of the announcement caught many investors off guard. The equity markets reacted sharply, with the S&P 500 dropping 20% from its peak. The U.S. bond market saw a move of similar magnitude, with the 10-year Treasury yield selling off 49 basis points between April 4 to 11. It’s unusual for bond yields to change so rapidly and what made this shift even stranger was that the stock market was declining at the same time. Typically, when stock prices experience a significant sell off, bond yields decrease as money flows into Treasuries. The unusual behavior in the bond market caught the attention of the Trump administration and rather than risk a liquidity crisis, the administration decided to implement a 90-day delay on the higher tariffs.

The U.S. economy relies heavily on a well-functioning bond market. When the bond market experiences disruptions or liquidity issues the economy begins to sputter. On April 2, 2025, the Trump administration unveiled a set of tariffs on imports into the U.S., and even higher tariffs on goods from about 60 countries that have a large trade deficit. While markets had been bracing for the tariff announcement, the scale and scope of the announcement caught many investors off guard. The equity markets reacted sharply, with the S&P 500 dropping 20% from its peak. The U.S. bond market saw a move of similar magnitude, with the 10-year Treasury yield selling off 49 basis points between April 4 to 11. It’s unusual for bond yields to change so rapidly and what made this shift even stranger was that the stock market was declining at the same time. Typically, when stock prices experience a significant sell off, bond yields decrease as money flows into Treasuries. The unusual behavior in the bond market caught the attention of the Trump administration and rather than risk a liquidity crisis, the administration decided to implement a 90-day delay on the higher tariffs.

The uncertainty surrounding tariffs is not the only issue the Treasury market is dealing with. On May 16, 2025, Moody’s downgraded the United States’ credit rating, making it the last major rating agency to remove the U.S.’s AAA rating. The rating agency cited the likelihood of “persistent, large fiscal deficits” that will drive the government’s debt and interest burden higher. S&P Global ratings downgraded the U.S. government’s credit rating in 2011, and Fitch Ratings issued a downgrade in 2023. Both cited similar concerns over growing budget deficits and doubts about the ability to pay them. As interest payments now surpass defense spending, more money will be spent servicing debt than defending the country for the first time. Without reform, debt is projected to increase from 120% to 156% of GDP by 2055.

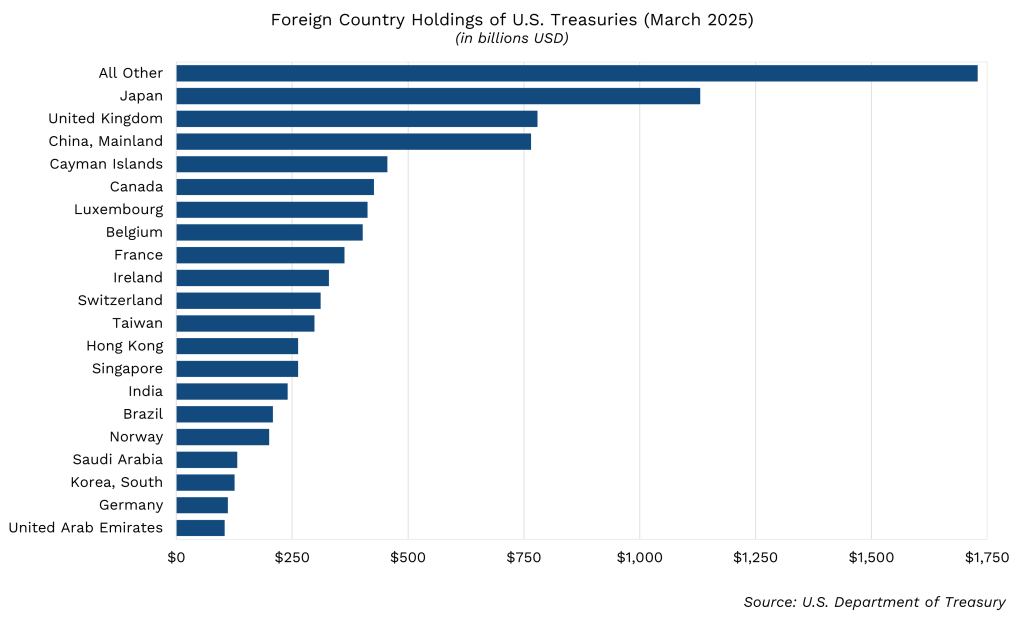

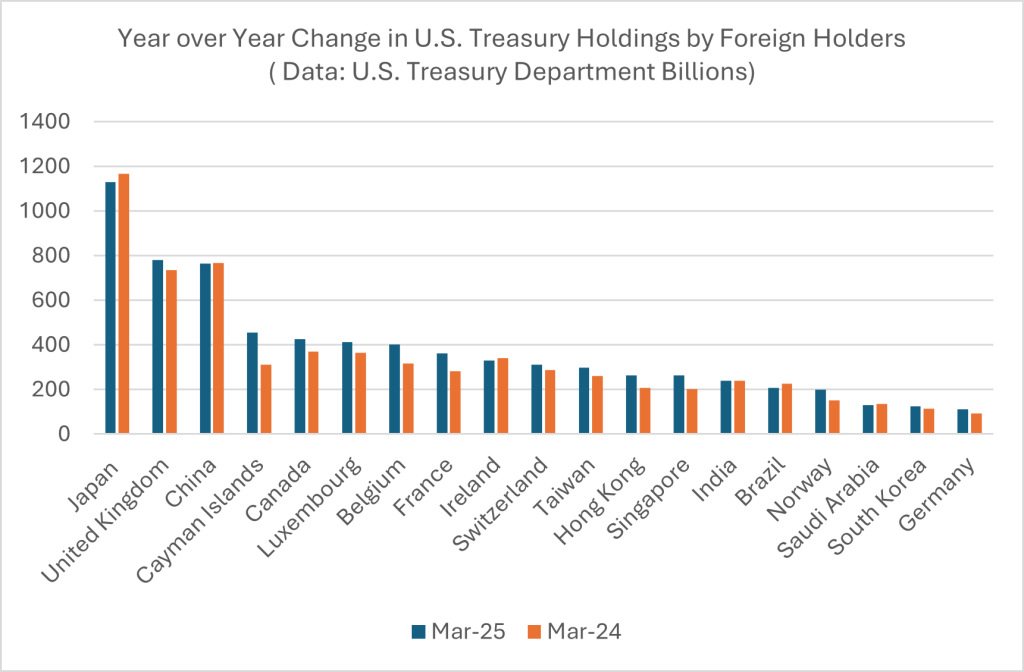

Foreign central banks have been net sellers of longer-term U.S. Treasury bonds and notes for several consecutive months. However, this selling is largely offset by purchases of shorter-dated Treasury Bills by these same institutions, suggesting a shift towards greater liquidity in their portfolios. The total share of U.S. federal debt held by foreigners has declined to 25% from approximately 30% in recent years, as the overall U.S. debt has grown faster.

Another fallout of the U.S. debt concerns is the U.S. Dollar. The dollar is not currently facing an imminent threat to its reserve currency status, though its dominance is gradually shifting. Efforts by nations to “de-dollarize” by increasing trade in local currencies and developing alternative payment systems contribute to this trend. Concerns over U.S. foreign taxation and the “weaponization” of the dollar through sanctions has also motivated some countries to seek alternatives. However, the dollar’s resilience stems from the unmatched depth and liquidity of U.S. financial markets, and strong network effects. No other currency, including the Euro or Chinese Renminbi, currently possesses the combination of liquidity, stability, and convertibility to rapidly assume the dollar’s leading role. While the global financial landscape is evolving, any significant transition away from dollar dominance is expected to be measured in decades, not months or even years.

The opinions expressed in this post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual. It is only intended to provide education about the financial industry. Individual investment positions discussed should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. Please remember that investing involves risk of loss of principal and capital. Nelson Capital Management, LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. No advice may be rendered by Nelson Capital Management, LLC unless a client service agreement is in place. Likes and dislikes are not considered an endorsement for our firm.

Receive our next post in your inbox.