Nelson Capital Management

The second quarter of 2025 witnessed a spectacular amount of volatility. Liberation Day on April 2nd and the Trump Administration’s reciprocal tariff announcement triggered a swift selloff that briefly pushed the S&P 500 into bear market territory, down 20% from its February 19th peak. However, the Trump Administration quickly announced a 90-day pause on the reciprocal tariffs, and by May 2nd, the post-Liberation Day losses had been fully erased.

Earnings season further buoyed sentiment. Roughly 78% of S&P 500 companies beat earnings expectations, surpassing historical averages. Blended year-over-year earnings growth topped 13%. Though some companies withdrew guidance due to macroeconomic uncertainty, many talked up their strategies for managing the expected tariffs. AI momentum fueled strong results among technology companies, and hopes of ramping productivity helped propel stock prices to new heights.

Earnings season further buoyed sentiment. Roughly 78% of S&P 500 companies beat earnings expectations, surpassing historical averages. Blended year-over-year earnings growth topped 13%. Though some companies withdrew guidance due to macroeconomic uncertainty, many talked up their strategies for managing the expected tariffs. AI momentum fueled strong results among technology companies, and hopes of ramping productivity helped propel stock prices to new heights.

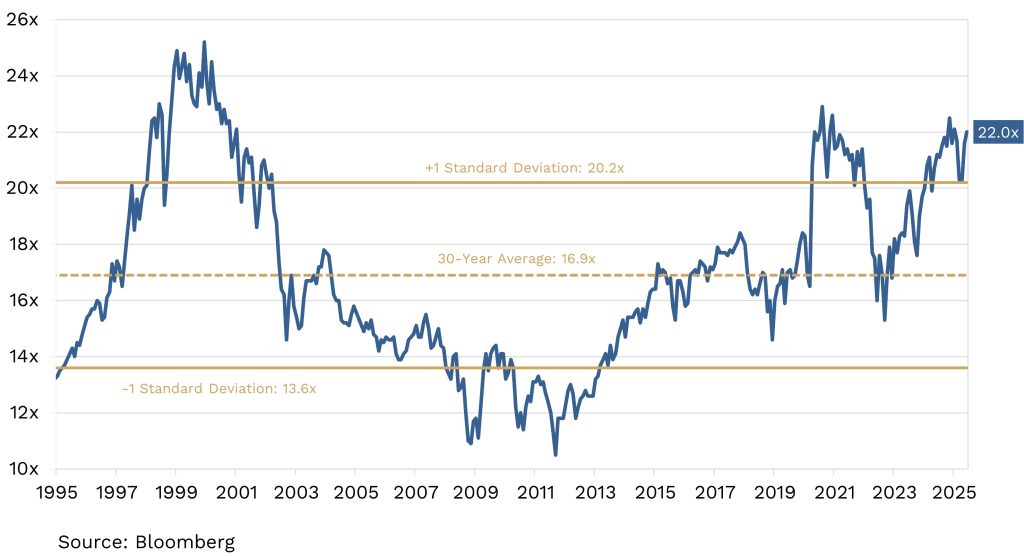

Geopolitical tensions escalated, particularly between Israel and Iran. On June 22nd, the U.S. bombed three nuclear facilities in Iran. Yet markets appeared unfazed, rallying 3.5% in the week that followed. The quarter ended on June 30th with the S&P at an all-time high, up over 6% since the start of the year, the Liberation Day volatility all but forgotten. The forward price-to-earnings ratio of the index hit 22x, well above 30-year historical average multiple of 17x.

The “Big, Beautiful Bill,” which extends key provisions of the 2016 Tax Cuts and Jobs Act, was passed ahead of the July 4th deadline. After much handwringing from Republican holdouts (and Elon Musk) over certain sticking points—including Medicaid cuts, the SALT cap deduction, and the bill’s projected impact on the federal budget deficit—they ultimately fell in line and voted yes.

Labor market data remains resilient, though is beginning to show signs of softening. The June labor report showed steady hiring, with 147,000 jobs added in June. On a year-over-year basis, job growth is about 1.15%, above the 1% threshold. We have noted that when this rate drops below 1%, we usually see a recession follow shortly thereafter.

Consumer spending also generally remains stable, though signs of strain are emerging. Delinquency rates on credit card, auto and student loans are at 15-year highs, though mortgage delinquencies remain low. Higher-income consumers, typically homeowners with investment portfolios, are better off than lower-income consumers, who have been more exposed to price increases over the past five years.

We detect a worrying degree of complacency. Markets are championing the post-Liberation Day developments as if all overhangs have been removed. We question this logic, as much uncertainty remains, particularly with the impact of tariffs.

Housing data show no broad-based price softening, though anecdotal evidence suggests more homes are underwater in certain markets. Inventory levels are rising, and sellers are increasingly outnumbering buyers in many neighborhoods.

The Federal Reserve is taking a “wait and see” approach to cutting rates. While tariffs are expected to push prices higher, policymakers have indicated that they see this as a one-time, transitory inflation shock rather than a persistent inflation driver. Markets are anticipating one or two interest rate cuts between now and the end of the year, with the first likely in September.

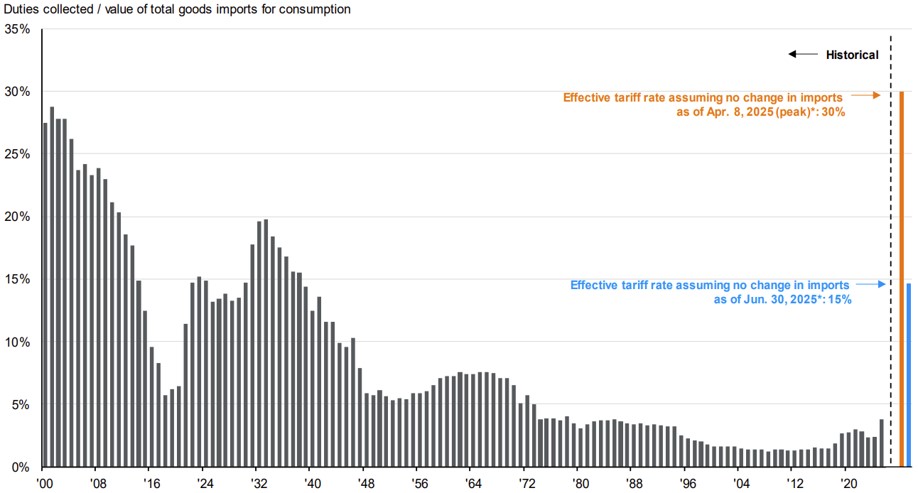

We detect a worrying degree of complacency. Markets are championing the post-Liberation Day developments as if all overhangs have been removed. We question this logic, as much uncertainty remains, particularly with the impact of tariffs. Even if trade negotiations succeed and the effective tariff rate settles in the 10-20% range that many analysts expect, this would represent a significant escalation from the ~2% effective tariff rate at the start of the year. Most companies pre-stocked inventory to get ahead of the April tariff implementation. The true cost will become clearer later this fall, when companies run out of pre-tariff inventory. Most firms expect to pass cost increases on to consumers, which could suppress consumer spending and lead to dampened earnings growth.

The geopolitical situation remains precarious and could flare at any moment. Markets have historically shrugged off these events, though a wider escalation could have a broader impact.

Finally, fiscal risks are mounting. The U.S. now holds the largest peacetime budget deficit in history, with debt-to-GDP at its highest level since World War II. In May, Moody’s became the last of the three major rating agencies to downgrade the U.S. credit rating from Aaa to Aa1, citing rising debt and governance concerns. Once again, markets barely reacted.

Though we do not recommend timing the market, we do believe it makes sense to exercise caution at these valuation levels, given the hazards outstanding.

The opinions expressed in this post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual. It is only intended to provide education about the financial industry. Individual investment positions discussed should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. Please remember that investing involves risk of loss of principal and capital. Nelson Capital Management, LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. No advice may be rendered by Nelson Capital Management, LLC unless a client service agreement is in place. Likes and dislikes are not considered an endorsement for our firm.

Receive our next post in your inbox.