Nelson Capital Management

Equity markets continued their climb in the third quarter, with the S&P 500 gaining 8% over the past three months and bringing year-to-date returns to just under 15%. International markets have fared even better: emerging market equities are up 28% and developed markets 26% since the start of the year. While valuations remain elevated (more on that later), earnings growth has largely met or exceeded expectations, and many companies have delivered positive surprises. Importantly, gains are no longer confined to the largest names. Although the top 10 companies in the S&P 500 continue to drive much of the performance, the equal-weighted index has returned 9.5% year-to-date, signaling a healthier broadening of market participation.

Some argue that today’s higher valuations are justified. Corporate profit margins have steadily expanded, rising to 13.6% from about 10% a decade ago and 9% two decades ago. Consumer spending remains resilient despite some labor market softness, and credit conditions are favorable, with tight spreads and default rates at historic lows. Fiscal policy has also played a role, with the OBBB enacting permanent business and household tax cuts, building on the 2017 Tax Cuts and Jobs Act.

Some argue that today’s higher valuations are justified. Corporate profit margins have steadily expanded, rising to 13.6% from about 10% a decade ago and 9% two decades ago. Consumer spending remains resilient despite some labor market softness, and credit conditions are favorable, with tight spreads and default rates at historic lows. Fiscal policy has also played a role, with the OBBB enacting permanent business and household tax cuts, building on the 2017 Tax Cuts and Jobs Act.

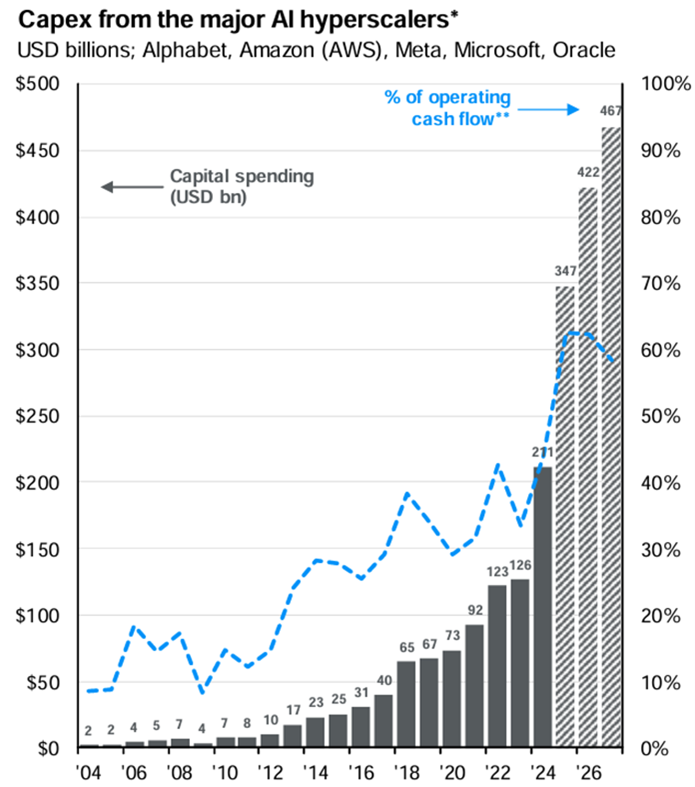

Artificial intelligence remains the defining growth theme. Analysts expect capital expenditures from leading AI hyperscalers (Alphabet, Amazon, Meta, Microsoft, Oracle) to surge from $126 billion in 2023 to over $400 billion this year. These firms have ample balance-sheet resources to fund the build-out, fueling demand for suppliers like NVIDIA and Broadcom. Investors broadly recognize that AI is ushering in a new technological era, reshaping information processing and task automation, with the potential to unlock major productivity and growth gains.

Monetary policy is also supportive. After cutting its benchmark rate by a full percentage point in 2024, the Federal Reserve paused before resuming with a 0.25% cut at its September 2025 meeting, lowering the target range to 4.0%–4.25%. Fed Chair Jerome Powell characterized the move as a “risk management cut,” a preemptive step against a potentially weakening labor market. Another 0.5% in cuts is expected before year-end. These steps have provided an additional tailwind to equity markets.

Risks remain, however. Valuations are stretched, with the S&P 500 trading at 22.2x forward earnings, comparable to 2021 highs and approaching levels last seen during the dot-com bubble. Market concentration also poses challenges: the top 10 companies now represent more than 39% of the index, the highest since the 1960s. Unlike that earlier era, when leadership was spread across sectors (AT&T, GM, Exxon), today’s dominance is concentrated in AI-related firms, amplifying the risks of company-specific setbacks and potential “groupthink” in markets.

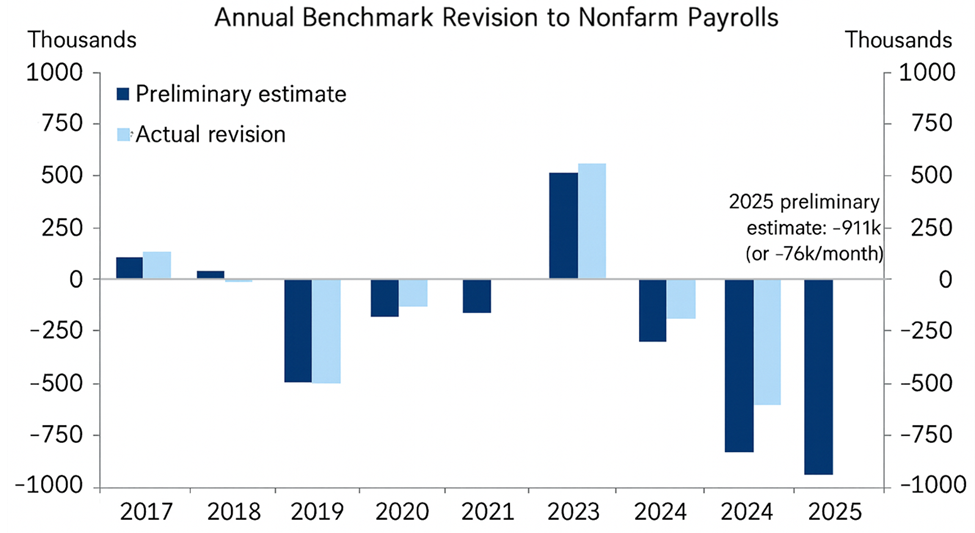

Job creation and openings are slowing, a trend the Fed acknowledged at its September meeting. Data quality is deteriorating, with survey response rates falling over the past decade, complicating interpretation of economic conditions.

Skepticism around AI investment is growing. Some analysts question whether the projected $400 billion in spending will deliver proportional returns. A recent Economist article asked, “What if the $3trn AI investment boom goes wrong?” Meanwhile, MIT’s GenAI Divide study found that 95% of organizations investing $30–40 billion in generative AI reported no measurable return. Training newer models has become increasingly expensive while delivering more incremental, rather than transformative, improvements. Even industry leaders like Sam Altman and Mark Zuckerberg have acknowledged the possibility of an AI bubble.

Traditional economic indicators also show strain. Job creation and openings are slowing, a trend the Fed acknowledged at its September meeting. Data quality is deteriorating, with survey response rates falling over the past decade, complicating interpretation of economic conditions. Prices for shipping and lumber, often early signals of slower activity, have softened. Consumer spending remains strong, but increasingly concentrated: over half now comes from the top 10% of earners. While their financial strength provides stability, reliance on a narrow base of consumers poses its own risks.

Though tariff policy remains in flux, as of this writing, the statutory tariff rate stands at around 19%, the highest level since the 1930s. Firms that pre-stocked inventories earlier this year must now replenish at higher cost. Some have strategies in place to offset tariffs, but others face a choice between raising prices or absorbing margin compression. Markets have largely dismissed these concerns, though the full impact of higher tariffs has yet to materialize.

Markets have largely brushed off the recent government shutdown, with many participants expecting it to be brief and cause limited economic damage. Still, the disruption could complicate the Federal Reserve’s policy outlook, as key economic releases, including the BLS labor market report, are delayed. Some now speculate the shutdown could stretch through the end of the month, overlapping with the Fed’s October meeting.

Despite these challenges, liquidity risk appears low. The Fed retains significant policy flexibility, with room to cut rates more aggressively or expand its balance sheet if conditions deteriorate. Valuations may compress, but we do not anticipate a systemic liquidity crisis.

The opinions expressed in this post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual. It is only intended to provide education about the financial industry. Individual investment positions discussed should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. Please remember that investing involves risk of loss of principal and capital. Nelson Capital Management, LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. No advice may be rendered by Nelson Capital Management, LLC unless a client service agreement is in place. Likes and dislikes are not considered an endorsement for our firm.

Receive our next post in your inbox.