Nelson Capital Management

2025 was another banner year for equity markets, with the S&P 500 returning approximately 17.9%. This performance was achieved despite significant volatility, including a sharp 15% drawdown in early April following the “Liberation Day” tariff announcement. International equities posted even stronger results, with non-U.S. stocks rising roughly 32% for the year to outpace the S&P 500 by double digits. Small-cap stocks, which have struggled in recent years, also rebounded decisively, with the Russell 2000 finishing 2025 12.8% higher after roaring back from its April lows. The rally in 2025 was remarkably inclusive, lifting all 11 sectors of the S&P 500. Aside from pullbacks in oil and Bitcoin, nearly every other asset class participated in the year’s upward momentum.

2025 was another banner year for equity markets, with the S&P 500 returning approximately 17.9%. This performance was achieved despite significant volatility, including a sharp 15% drawdown in early April following the “Liberation Day” tariff announcement. International equities posted even stronger results, with non-U.S. stocks rising roughly 32% for the year to outpace the S&P 500 by double digits. Small-cap stocks, which have struggled in recent years, also rebounded decisively, with the Russell 2000 finishing 2025 12.8% higher after roaring back from its April lows. The rally in 2025 was remarkably inclusive, lifting all 11 sectors of the S&P 500. Aside from pullbacks in oil and Bitcoin, nearly every other asset class participated in the year’s upward momentum.

Looking ahead, Wall Street analysts are broadly predicting another market rally in 2026, supported by economic data that suggest favorable conditions. Inflation has retreated and continues to trend toward the Federal Reserve’s 2% target. Although the labor market has softened, U.S. consumers have largely maintained their spending levels. In addition, the OBBBA is expected to provide further stimulus through tax cuts for many consumers. Third-quarter GDP growth came in at a robust 4.3%, well above the consensus estimate of 3.2% and an acceleration from the 3.8% growth rate recorded in the second quarter of 2025. Even the tariff-related fears that rattled markets in April have largely faded, as many companies have secured exemptions or implemented workarounds.

Artificial intelligence remains a powerful structural tailwind. Major hyperscalers have committed hundreds of billions of dollars to unlock the next wave of productivity gains, with even larger investments planned for next year. These capital expenditures have translated into meaningful earnings growth. S&P 500 companies collectively delivered 11% earnings growth last year, and analysts project 14% growth in 2026.

The Federal Reserve has reiterated its dual mandate of managing inflation and employment. As inflation has eased alongside slowing job growth, the Fed has been able to lower interest rates. Three rate cuts in 2025 reduced the benchmark rate by 0.75%, and one additional cut is expected in 2026, which would bring the year-end target range to 3.25%–3.50%. This easing cycle represents another meaningful tailwind for equities.

While high concentration isn’t inherently negative, it intensifies idiosyncratic risk. Because many of these leaders share a deep exposure to the AI theme, a sharp decline in any single constituent could trigger a disproportionate and correlated impact on the broader market.

Beneath these positive indicators, fundamental risks continue to simmer. Valuations for the S&P 500 are approaching levels last seen during the height of the dot-com bubble, prompting frequent comparisons between that period and today’s AI-driven enthusiasm. Rising competition, off-balance-sheet financing, higher leverage, and circular funding arrangements have fueled concerns about a potential AI bubble. Notably, contrarian investor Michael Burry, famous for his bet against the housing market ahead of the 2008 financial crisis, has begun betting against several high-profile AI beneficiaries, including Nvidia (tkr: NVDA) and Palantir (tkr: PLTR). Additionally, surging AI-related power consumption has strained electrical grids, increased carbon emissions and water usage, and driven up energy costs.

While investors welcomed the latest inflation report’s signs of cooling prices, the celebration was tempered by reliability concerns, as the month-long government shutdown disrupted critical data collection. Simultaneously, the Federal Reserve’s independence has faced renewed scrutiny. With President Trump poised to nominate Jerome Powell’s successor, his public advocacy for lower rates has heightened fears of political interference. Although policy is determined by committee, any perceived loss of autonomy threatens the Fed’s long-term credibility.

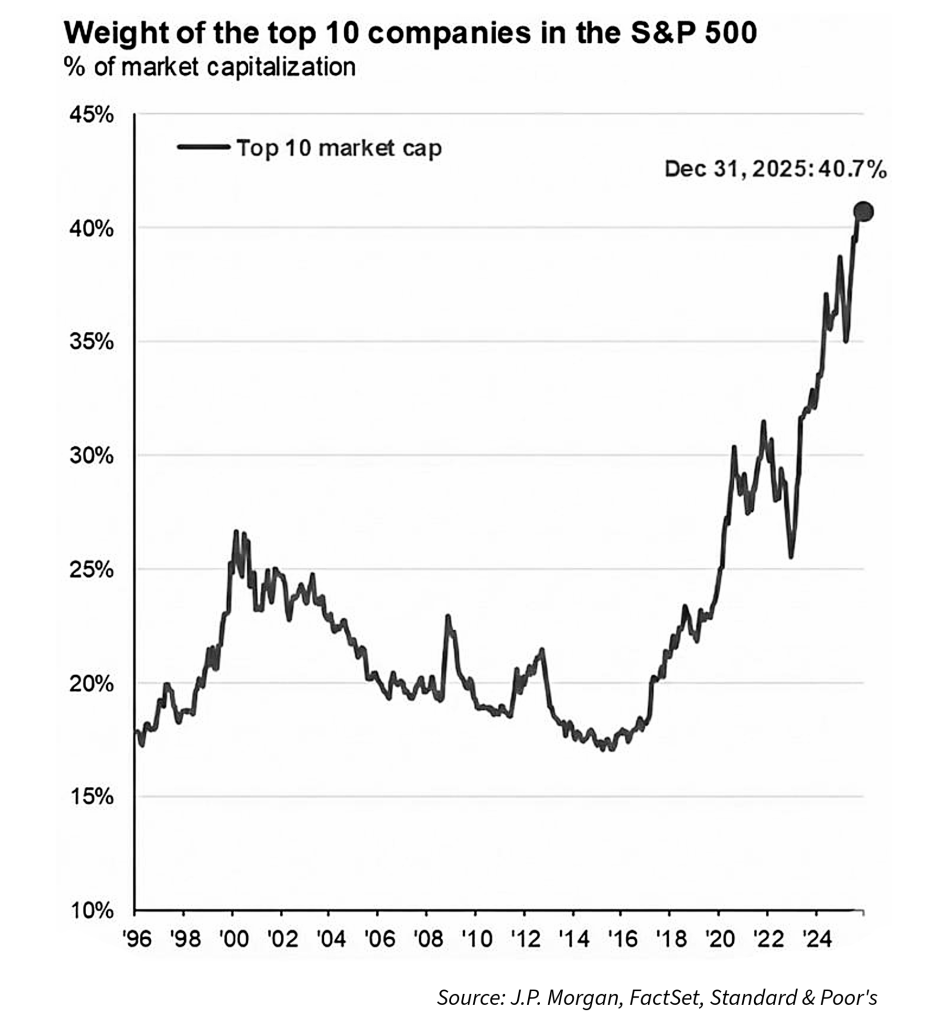

Growing concentration within the S&P 500 presents another structural concern. The top ten companies now represent over 41% of the index, a significant leap from the 27% seen at the peak of the dot-com era. While high concentration isn’t inherently negative, it intensifies idiosyncratic risk. Because many of these leaders share a deep exposure to the AI theme, a sharp decline in any single constituent could trigger a disproportionate and correlated impact on the broader market.

Some contrarians argue that the near-universal expectation of a rally itself is a warning sign of groupthink. Yet signs of widespread euphoria remain elusive. Despite strong gains in AI-related stocks, skepticism about an AI bubble is pervasive. Consumer sentiment remains near historic lows at 52.9, well below the April 2020 reading of 71.8 during the height of the global pandemic. Meanwhile, gold, often viewed as a safe-haven asset, rose more than 70% in 2025, signaling ongoing investor unease.

Revisiting the dot-com parallel, the current market may be approaching a 1999-style peak, or we could still be in the early innings of a long-term AI expansion, akin to 1995. This tension recalls a famous exchange from The Big Short: when Michael Burry (played by Christian Bale) insists, “I may be early, but I’m not wrong,” he is met with the blunt reality of market timing: “It’s the same thing!”

Rather than taking aggressive tactical bets against the broader market or the AI theme, we are prioritizing diversification to mitigate inherent risks. Over the past two years, we have strategically increased international exposure, capitalizing on more attractive valuations abroad. Our custom portfolio approach further enables us to selectively trim positions in companies we deem overvalued, overleveraged, or fundamentally mismanaged. Finally, we remain disciplined in rebalancing portfolios to their target allocations, ensuring that current market volatility does not compromise long-term investment objectives.

The opinions expressed in this post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual. It is only intended to provide education about the financial industry. Individual investment positions discussed should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. Please remember that investing involves risk of loss of principal and capital. Nelson Capital Management, LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. No advice may be rendered by Nelson Capital Management, LLC unless a client service agreement is in place. Likes and dislikes are not considered an endorsement for our firm.

Receive our next post in your inbox.