Nelson Capital Management

During the American War of Independence, to finance the war costs, the Continental Congress authorized the printing of paper money. These became known as “continentals” and were printed in exponentially greater quantities as the war progressed to the point where inflation became rampant and the currency virtually worthless. From 1775 to 1791, most commerce was conducted in gold or silver, often using Spanish Doubloons.

During the American War of Independence, to finance the war costs, the Continental Congress authorized the printing of paper money. These became known as “continentals” and were printed in exponentially greater quantities as the war progressed to the point where inflation became rampant and the currency virtually worthless. From 1775 to 1791, most commerce was conducted in gold or silver, often using Spanish Doubloons.

In 1791, at the urging of Treasury Secretary Alexander Hamilton, Congress established the First Bank of the United States. Agrarian interests conflicted with those of financial and urban businesses, and there was a power struggle over the control of commerce. Shortly after winning independence from England, Americans were wary of central banks and big government. In 1811, by a very narrow margin, Congress did not renew the bank’s charter. Five years later, again by a narrow margin, Congress authorized the Second Bank of the US, which also was not renewed at the end of its 20-year charter in 1836.

The period from 1836 until the end of the Civil War was known as the Free Banking Era. State-chartered and unchartered banks issued currency, mostly redeemable in gold or silver. After the experience with runaway inflation and worthless continentals, commerce was transacted via paper currency that was redeemable for hard assets. However, the exchange rates between banks were high and if a bank went under, their notes became worthless. The era was rife with scams. In 1863, the National Banking Act was passed, establishing nationally-chartered banks. High taxes on state-chartered bank currency drove demand for currency issued by the newly-chartered banks, effectively creating a uniform national currency.

For most of the 19th century, the US had paper currency that was redeemable in gold or silver, which made it inelastic. Especially in the post-Civil War period, the country experienced a series of robust economic expansions alternating with severe economic contractions. The discovery and mining of gold and silver was not in sync with commerce’s need for increasing money supply. This meant that during an expansion, there wouldn’t be enough currency to enable buyers to acquire goods, causing prices to fall. During a contraction, demand would decrease resulting in monetary surpluses, creating inflation. These shortages and surpluses exacerbated the severity of the economic booms and busts. In the 1890’s there was a deep and lengthy depression.

Market and economic panics continued into the early 1900’s with the Panic of “Aught 7” (1907) being particularly severe. The market only stabilized when J.P. Morgan stepped in as the lender of last resort, effectively acting as a central bank. Senator Nelson Aldrich, who originally opposed a central bank, went to Europe to study the central banks of England, France, and Germany where financial panics were far less frequent, and eventually became a proponent. Congress passed the Aldrich-Vreeland Act in 1908, which authorized emergency currency issuance during times of crisis and established a Monetary Commission, whose purpose was to find a long-term solution to the banking and monetary problem. The Commission eventually proposed creating a Federal Reserve.

In December 1913 Woodrow Wilson signed the Federal Reserve Act, creating a decentralized central bank. Prior to this, US dollars were either Gold or Silver Certificates, which were redeemable for the metals, with gold at just over $20 per ounce. This allowed mints to issue Federal Reserve Notes which were exchangeable with Gold and Silver Certificates, but not with the metals. This freed the supply of money from the volume of metal in the mints. However, since Federal Reserve Notes were fungible with Gold Certificates, the value of the dollar remained at $20.

In 1933, during the depths of the Depression, under President Roosevelt, the US recalled all Certificates, outlawed the ownership of gold bullion and coins and subsequently announced that the US would redeem dollars from international trading partners at $32 per ounce. This was effectively a 50% devaluation of the US Dollar. Countries around the globe did the same thing, which negated the benefit of devaluation. All of this further stretched the connection between the US Dollar and gold.

Finally, in 1972, President Nixon eliminated the fixed conversion rate, severing the dollar’s connection to hard assets. Since then, the US (and now all other countries) has had a Fiat currency backed only by the “Full Faith and Credit” of the United States.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Capital Management, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

The global selloff in equity markets put enormous pressure on the U.S. bond market in the month of March, raising concerns about the safety and liquidity of fixed income. As panic abated toward end of the quarter, credit markets rebounded and some normalcy returned to trading.

In mid-March, investors sold bonds and pulled cash from bond funds of all types at a record pace, prompting a vicious cycle of selling. Disruptions were felt in the U.S. Treasury market, which is typically immune to liquidity constraints. U.S. Treasury bill yields traded below zero as investors exited longer and less liquid bonds and fled to the safety of bills. At the end of the quarter, the 3-month Treasury bill and 10-year Treasury yielded 0.02% and 0.68%, respectively.

In mid-March, investors sold bonds and pulled cash from bond funds of all types at a record pace, prompting a vicious cycle of selling. Disruptions were felt in the U.S. Treasury market, which is typically immune to liquidity constraints. U.S. Treasury bill yields traded below zero as investors exited longer and less liquid bonds and fled to the safety of bills. At the end of the quarter, the 3-month Treasury bill and 10-year Treasury yielded 0.02% and 0.68%, respectively.

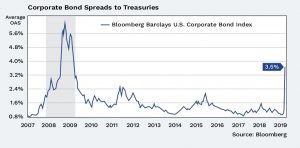

The corporate bond market came to a standstill as investors all tried to rush for the exits at the same time. Many investment grade and junk-rated debt offerings stopped trading. The spread (difference) between U.S. Treasury yields and investment grade bond yields widened from less than 1 percent before the COVID-19 crisis to over 3%. Junk bond spreads spiked to over 9%. Potential buyers stayed away as the market contemplated which companies would survive and which might go bankrupt.

Municipal bonds declined in value as cities and states closed nonessential services. The risk of an economic recession and the financial strain placed on local governments due to a drop in tax revenue had bondholders concerned.

The disruptions have prompted a series of extraordinary Federal Reserve interventions to keep capital flowing and to calm the markets. The Fed has lowered its benchmark target rate to zero, eased regulatory requirements for some banks, opened up new lending facilities and indicated it would buy bonds in unlimited quantities. In its March 23 announcement, the Fed established three new lending facilities to provide up to $300 billion of liquidity by purchasing corporate bonds, a wider range of municipal bonds and securities tied to such debt as auto and real estate loans. With the passage of the Coronavirus Aid, Relief, and Economic Security (CARES) Act on Friday March 27, Congress approved an additional $454 billion for the Fed to lend. By providing the Treasury Department with a sizable pot of money, Congress has given the central bank more flexibility to ramp up lending and absorb initial losses.

The disruptions have prompted a series of extraordinary Federal Reserve interventions to keep capital flowing and to calm the markets. The Fed has lowered its benchmark target rate to zero, eased regulatory requirements for some banks, opened up new lending facilities and indicated it would buy bonds in unlimited quantities. In its March 23 announcement, the Fed established three new lending facilities to provide up to $300 billion of liquidity by purchasing corporate bonds, a wider range of municipal bonds and securities tied to such debt as auto and real estate loans. With the passage of the Coronavirus Aid, Relief, and Economic Security (CARES) Act on Friday March 27, Congress approved an additional $454 billion for the Fed to lend. By providing the Treasury Department with a sizable pot of money, Congress has given the central bank more flexibility to ramp up lending and absorb initial losses.

In response to the liquidity constraints, we have taken steps to ensure our safe investments are secure for what is currently an unknown period of market disruption. Our focus has always been to invest in high-quality investment grade bonds and not chase higher yields by buying lower quality debt. We will continue to monitor the fixed income markets closely as we move more money into cash and U.S. Treasuries. The good news is that even as U.S. government debt grows to levels not seen since World War II, global demand for U.S. Treasuries remains strong.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.