Nelson Capital Management

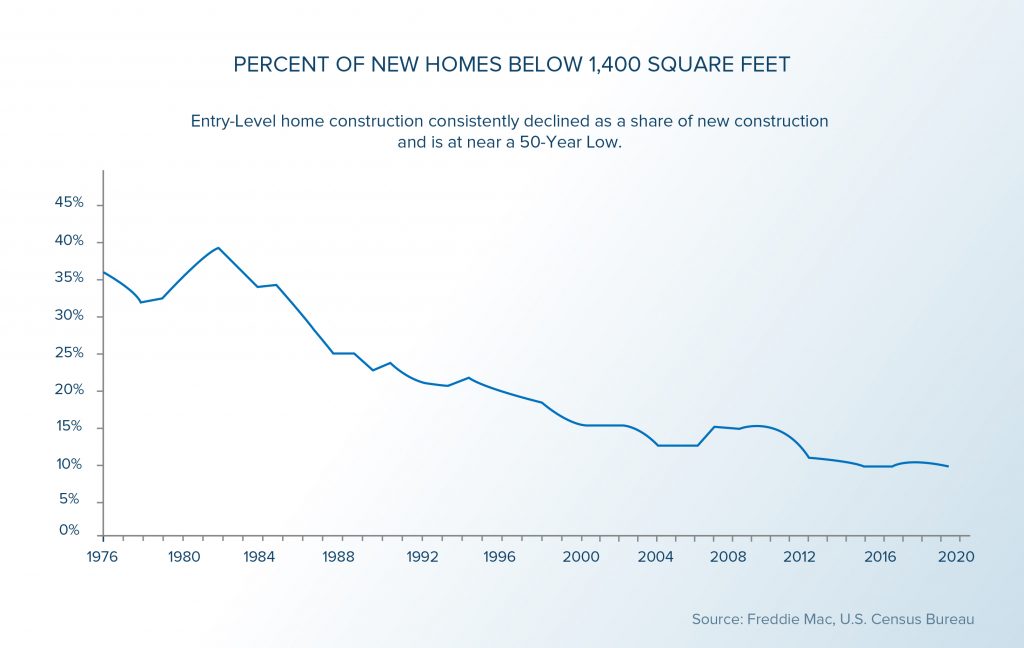

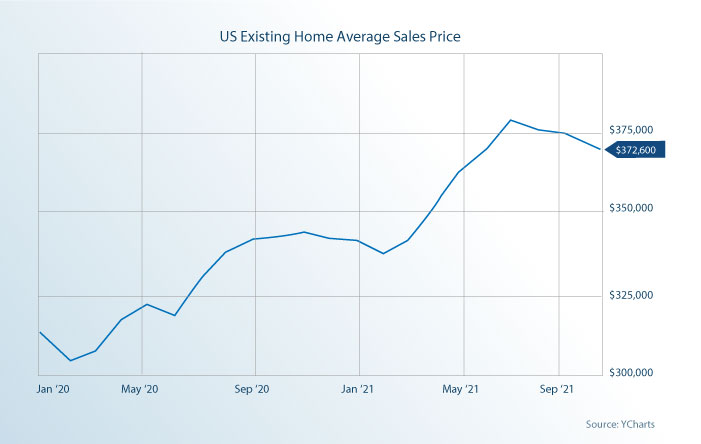

The COVID-19 pandemic sparked a massive run-up in the housing market as mortgage rates fell and demand surged, while inventory levels reached record lows. The spike in demand can be attributed to several short and long-term trends. First, millennials are increasingly forming households and entering the home buying market, further exacerbating the extreme shortage in starter homes as evidenced by data from Freddie Mac and the Harvard State of the Nation’s Housing 2021 study. Increased popularity of remote work has driven many to seek larger homes with a dedicated workspace. Lastly, relative to prior generations, more baby boomers have opted to age in place, meaning they are accommodating their existing homes to meet their evolving needs rather than moving to a smaller homes, care facilities or in with other family members. Nelson Capital’s portfolio is positioned to benefit from the housing boom through our exposure to D.R. Horton (tkr: DHI) and Equity Residential (tkr: EQR).

D.R. Horton, the largest homebuilder in the U.S. by volume, constructs and sells mostly single-family homes designed primarily for the entry-level and move-up markets. It operates in the Midwest, Mid-Atlantic, Southeast, Southwest, and Western regions of the U.S. The company sells about 65,000 homes per year with an average selling price of around $300,000. D.R. Horton has four brands that each cater to a different demographic. Express Homes focuses on price-conscious entry-level buyers and represents about 30% of homes sold. D.R. Horton Homes, the most dominant brand, focuses on first-time buyers and move-up buyers. This brand spans 96 markets across 30 states and represents 66% of homes sold. The Freedom Homes brand builds active adult communities designed for older adults who are generally able to care for themselves. This brand represents 3% of homes sold. Just 1% of homes sold are attributable to its smallest brand, Emerald Homes, which caters to the higher end of the housing market.

D.R. Horton, the largest homebuilder in the U.S. by volume, constructs and sells mostly single-family homes designed primarily for the entry-level and move-up markets. It operates in the Midwest, Mid-Atlantic, Southeast, Southwest, and Western regions of the U.S. The company sells about 65,000 homes per year with an average selling price of around $300,000. D.R. Horton has four brands that each cater to a different demographic. Express Homes focuses on price-conscious entry-level buyers and represents about 30% of homes sold. D.R. Horton Homes, the most dominant brand, focuses on first-time buyers and move-up buyers. This brand spans 96 markets across 30 states and represents 66% of homes sold. The Freedom Homes brand builds active adult communities designed for older adults who are generally able to care for themselves. This brand represents 3% of homes sold. Just 1% of homes sold are attributable to its smallest brand, Emerald Homes, which caters to the higher end of the housing market.

After the Great Recession, many homebuilders scaled back operations or simply went out of business. D.R. Horton is one of the few public homebuilders that pays a dividend (0.9% dividend yield), and was able to maintain that dividend throughout the housing crisis, demonstrating its dominance in the market. Following the housing crisis, D.R. Horton adopted a “land-light” strategy with contracts that require a small deposit up front in exchange for the right, but not the obligation, to buy land or lots at predetermined prices when the company is ready to begin development. This strategy substantially reduces the risks associated with land ownership and enables D.R. Horton to control land and lot position with limited capital investment. Supply chain disruptions, rising raw material costs and a tight labor market may impact margins in the short term, but the demand for new housing remains robust, enabling D.R. Horton to pass on additional costs to consumers. Though there is some concern that the current housing conditions could be a bubble, this boom is much more stable than the previous bubble due to tighter underwriting standards, higher credit scores, larger down payments, and lack of housing supply.

After the Great Recession, many homebuilders scaled back operations or simply went out of business. D.R. Horton is one of the few public homebuilders that pays a dividend (0.9% dividend yield), and was able to maintain that dividend throughout the housing crisis, demonstrating its dominance in the market. Following the housing crisis, D.R. Horton adopted a “land-light” strategy with contracts that require a small deposit up front in exchange for the right, but not the obligation, to buy land or lots at predetermined prices when the company is ready to begin development. This strategy substantially reduces the risks associated with land ownership and enables D.R. Horton to control land and lot position with limited capital investment. Supply chain disruptions, rising raw material costs and a tight labor market may impact margins in the short term, but the demand for new housing remains robust, enabling D.R. Horton to pass on additional costs to consumers. Though there is some concern that the current housing conditions could be a bubble, this boom is much more stable than the previous bubble due to tighter underwriting standards, higher credit scores, larger down payments, and lack of housing supply.

The current housing market has made it difficult for some people seeking to buy a home. Rising prices mean higher down payments, which is the biggest hurdle for most first-time home buyers. Competition is fierce and some buyers put down 50% or even submit all-cash offers with zero contingencies. This has priced many other potential buyers out of the market as affordability moves beyond reach and they must to continue to rent.

Equity Residential, one of the leading residential REITs (Real Estate Investment Trust), acquires, develops, and manages luxury rental apartment properties. Most of Equity Residential’s properties are located in urban coastal markets, where residential REITs were hardest hit, resulting in significant drops in rent prices and generous concessions to attract new tenants. Residential REITs with Sunbelt exposure fared better during the pandemic as remote work drew people to more inland regions with a lower cost of living. Equity Residential is ramping up its exposure in Sunbelt states to diversify its portfolio, selling some older properties in California in favor of much newer properties in high-growth regions such as Austin, Dallas, and Atlanta. The company recently announced a strategic partnership with Toll Brothers (tkr: TOL) to develop apartment communities in key Equity Residential expansion markets.

Equity Residential, one of the leading residential REITs (Real Estate Investment Trust), acquires, develops, and manages luxury rental apartment properties. Most of Equity Residential’s properties are located in urban coastal markets, where residential REITs were hardest hit, resulting in significant drops in rent prices and generous concessions to attract new tenants. Residential REITs with Sunbelt exposure fared better during the pandemic as remote work drew people to more inland regions with a lower cost of living. Equity Residential is ramping up its exposure in Sunbelt states to diversify its portfolio, selling some older properties in California in favor of much newer properties in high-growth regions such as Austin, Dallas, and Atlanta. The company recently announced a strategic partnership with Toll Brothers (tkr: TOL) to develop apartment communities in key Equity Residential expansion markets.

At the onset of the pandemic, eviction moratoriums prevented landlords from removing tenants who were facing financial hardships. The expiration of these eviction moratoriums in August 2021 has not lead to mass evictions as once feared. Government programs have provided rental assistance to thousands of tenants, softening the impact to both tenants and landlords. Equity Residential has received $18.3M in governmental assistance payments so far this year.

As the pandemic abates, Equity Residential has seen occupancy and pricing trends improve while concessions are back in line with pre-pandemic levels. Renewal rates are exceeding expectations with little discrepancy in renewal behaviors for deal seekers who received significant discounts and more tenured residents. However, 86% of residents are locked into paying rents that are significantly below market prices. 2022 is expected to be a turning point for Equity Residential as many of these leases come up for renewal at more normalized rates and companies require workers to return to offices.

In addition to the imminent rebound in pricing that is expected to boost margins, continued investments in technological advancements such as Equity Residential’s AI Chatbot named “Ella” are optimizing efficiencies, leading to reduced staffing expenses and enhanced customer experiences. Equity Residential also pays shareholders a solid 2.85% dividend.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Capital Management, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

In the third quarter, Nelson Capital made several changes to our portfolio amidst the choppiness of the post-pandemic recovery. (See our blog post Inflation… Not So Transitory? for more information)

Within the Consumer Discretionary sector, we initiated a position in D.R. Horton (tkr: DHI), a leading homebuilder in the U.S. that constructs and sells primarily single-family homes. The recent all-time highs for home prices are driven by record-low home inventory combined with the trend of millennials forming households and entering the home-buying market. We believe D.R. Horton will benefit from the more dramatic scarcity of entry-level homes (per data from Freddie Mac and the Harvard State of the Nation’s Housing 2021 study), as nearly 90% of its homes sold are designed for entry-level and move-up buyers.

We also purchased a position in Equity Residential (tkr: EQR), one of the largest residential REITs, which owns primarily luxury apartments in urban, coastal markets. Residential REITs in these regions were hit exceptionally hard by the pandemic, with rent prices plummeting and concessions rising to attract new tenants as people left big cities for inland and suburban areas. Though an urban exodus was a concern early in the pandemic as remote work became the new norm, it is not likely as sticky as initially anticipated as more companies announce their plans to return to the office and people flock back to large cities. Additionally, the surge in home prices has made homeownership less attainable for many people and subsequently has driven the demand for apartments higher. Importantly, residential REITs typically hold up well in inflationary environments given their annual price resets.

We also purchased a position in Equity Residential (tkr: EQR), one of the largest residential REITs, which owns primarily luxury apartments in urban, coastal markets. Residential REITs in these regions were hit exceptionally hard by the pandemic, with rent prices plummeting and concessions rising to attract new tenants as people left big cities for inland and suburban areas. Though an urban exodus was a concern early in the pandemic as remote work became the new norm, it is not likely as sticky as initially anticipated as more companies announce their plans to return to the office and people flock back to large cities. Additionally, the surge in home prices has made homeownership less attainable for many people and subsequently has driven the demand for apartments higher. Importantly, residential REITs typically hold up well in inflationary environments given their annual price resets.

In the Materials sector, we sold our position in Danimer Scientific, (tkr: DNMR), a newly public biodegradable plastics company, after a series of short-seller reports led to a significant fall in the stock price. Given the volatility in the stock, we decided to use this as a tax loss opportunity to offset some of the significant gains taken in client portfolios this year.

With the reopening of the economy, we chose to reduce our overweight in the Consumer Staples sector by trimming our position in Costco (tkr: COST). Costco’s execution throughout the pandemic was impressive, especially as paper goods and other household staples flew off the shelves. However, given its outperformance over the past several quarters coupled with supply chain issues that are depressing margins, Costco may be challenged by tough comparable earnings metrics over the next year or two.

Looking ahead, we are keeping a close eye on supply chain issues, tightness in the labor market, and other inflationary pressures that may impact the markets as well as seeking out new opportunities that will complement our existing portfolio.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Capital Management, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

As the longest bull market in history continues, Nelson Roberts has found opportunities to reduce portfolio risk and increase dividend income through the addition of value-oriented stocks.

In the technology sector, we brought our exposure up to our target weight with the addition of International Business Machines Corporation (tkr: IBM). Typically, technology names are thought of as growth stocks. However, IBM trades at a forward price-to-earnings (PE) ratio of 11x which is very low relative to the PE ratios of its technology peers. Its core hardware and software business is profitable and it has started to invest in new initiatives such as analytics and cloud computing. Recently, IBM purchased Red Hat which will position the company as the leading hybrid cloud provider. Furthermore, it pays an attractive 4.8% dividend which increases our overall portfolio dividend yield.

We increased our exposure to the Real Estate Investment Trust (REIT) sector with the purchase of Ventas (tkr: VTR). Ventas provides a portfolio of senior housing, medical office buildings, life science buildings and hospitals. Recently, management diversified the business away from caring for patients and focused more on housing. Therefore, the addition of Ventas increases our exposure to the large aging baby boomer demographic. The company pays a 5.5% dividend and REITs tend to outperform late in the economic cycle and during recessions.

We increased our exposure to the Real Estate Investment Trust (REIT) sector with the purchase of Ventas (tkr: VTR). Ventas provides a portfolio of senior housing, medical office buildings, life science buildings and hospitals. Recently, management diversified the business away from caring for patients and focused more on housing. Therefore, the addition of Ventas increases our exposure to the large aging baby boomer demographic. The company pays a 5.5% dividend and REITs tend to outperform late in the economic cycle and during recessions.

We trimmed one of our oldest holdings, Costco Wholesale Corporation (tkr: COST). We believe Costco has good management, will continue to grow, and is relatively recession-resistant. However, its growth had made it one of our largest portfolio holdings and largest overweight relative to the S&P 500. We decided to take some money off the table while it was trading near an all-time high.

Similarly, we cut our position in TJX Companies (tkr: TJX), the parent company of off-price department stores: TJ Maxx, HomeGoods, and Marshalls. TJX has done extremely well over the last couple years as one of the few retailers that has withstood the intense competition from Amazon. With high inventory turnover, TJX creates a “treasure hunt” mentality, as shoppers never know what they are going to get. This draws customers in and helps maintain high same-store sales. We have long maintained TJX as a core holding in our consumer discretionary sector. However, we decided to trim our large overweight position slightly as it was trading near its all-time high. Over the course of 2019, we executed 13 buys (5 of which were adding to existing positions) and 15 sells (7 of which were trimming existing positions), representing portfolio turnover of 19.5%. We increased our portfolio’s dividend yield from 1.48% in the beginning of the year to 1.79% at year-end.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Our search for value-oriented stocks led us to the Real Estate Investment Trust (REIT) sector and Digital Realty Trust (tkr: DLR). The company manages 210+ data centers in 14 countries for 2,300+ customers globally while bringing in over $3 billion of annual revenue. They provide a turnkey solution to enable the deployment of offsite IT infrastructure that can scale with company growth. Digital Realty owns the buildings and provides multiple power and cooling systems, which are critical components to the reliability of data centers, and is able to execute on a customized data center solution for medium to large deployments in a matter of weeks.

Digital Realty’s three core offerings include wholesale data centers (77% of revenues), colocation data centers (13% of revenues) and connectivity (10% of revenues). Wholesale data centers are vast spaces (either a suite within a larger building or the entire building itself) leased to companies with only the space and power provided. Colocation or retail data centers rent out space in increments as small as a cage or cabinet and can scale up from there. The benefit of colocation is that multiple tenants can be hosted within the same building and there is an opportunity for connectivity.

Digital Realty’s three core offerings include wholesale data centers (77% of revenues), colocation data centers (13% of revenues) and connectivity (10% of revenues). Wholesale data centers are vast spaces (either a suite within a larger building or the entire building itself) leased to companies with only the space and power provided. Colocation or retail data centers rent out space in increments as small as a cage or cabinet and can scale up from there. The benefit of colocation is that multiple tenants can be hosted within the same building and there is an opportunity for connectivity.

Interconnection is an IT strategy that enables companies to exchange data directly, privately and securely. This strategy is often used to minimize bandwidth costs, increase security, reduce latency and help companies operate more efficiently. Colocation and connectivity services offer upside opportunities for Digital Realty, generating revenue growth and higher margins.

Wholesale data center providers in particular are seeing pricing pressures from large companies as these companies push towards more favorable contracts, though it is unlikely these large companies could easily switch data center providers due to extremely high switching costs. Despite this, recent strategic international expansions and land acquisitions have helped Digital Realty to diversify away from slower North American wholesale data center markets. These acquisitions have expanded Digital Realty into new markets around the world and broadened the company’s product offerings.

Wholesale data center providers in particular are seeing pricing pressures from large companies as these companies push towards more favorable contracts, though it is unlikely these large companies could easily switch data center providers due to extremely high switching costs. Despite this, recent strategic international expansions and land acquisitions have helped Digital Realty to diversify away from slower North American wholesale data center markets. These acquisitions have expanded Digital Realty into new markets around the world and broadened the company’s product offerings.

Digital Realty is poised to benefit from an increase in demand for colocation and connectivity around the world. Their contracts average at least five years, which provides more stable and predictable revenues, while also realizing cost advantages from scale and property ownership. Digital Realty’s focus on sustainability and efforts to create more energy efficient data centers benefit both their customers and the environment. The company pays a solid dividend of 3.5% and management expects positive momentum and acceleration to carry on through the remainder of the year. REITs have proven to be more resilient late in the economic cycle and during recessions, outperforming the S&P 500 by 7% since 1991, which is yet another reason why we anticipate Digital Realty will be a solid holding as we begin to see warnings signs of a potential economic downturn.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.