Nelson Capital Management

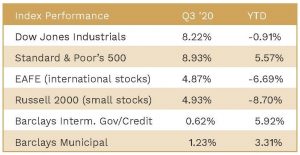

After suffering the fastest bear market on record earlier this year, the S&P 500 rebounded to a bull market and notched a new record high 116 trading days later. Stocks gave back some of the gains through the month of September, but the index still finished about 52% above its low on March 23. This eye-popping recovery was powered by the five largest names in the index—Apple, Microsoft, Google, Amazon, and Facebook. These five companies were already a substantial portion of the market-cap weighted S&P 500 at the beginning of the year. When the lockdowns began in March, these stocks saw positive tailwinds due to the countless secular changes: People rushed to buy computer hardware for remote work and school environments (Apple, Microsoft), shunned in-person shopping in favor of e-commerce (Amazon), and began spending more time on social media and other internet platforms (Google, Facebook). The pandemic has driven this market concentration to an even greater extreme.

Valuations, as measured by the S&P 500 trailing 12-month price-to-earnings ratio, reached nearly 27x in early September, flirting with the euphoric levels seen twenty years ago—in stark contrast to the deluge of abysmal economic data. The magnitude of Q2 GDP decline was more than double the decline witnessed during the depth of the financial crisis in 2009. This illustrates the remarkable “delinking” between the stock market and the economy. How can one explain this spectacular stock market recovery during the worst recession since World War II? We see a few possible explanations. First, the unprecedented amount of fiscal and monetary stimulus has given hope that the economy will remain afloat. The Federal Reserve has pledged to continue its pace of quantitative easing and has signaled that it will allow inflation to run higher before raising rates. This likely means zero percent interest rates will continue through 2023. Second, vaccine progress has allowed some optimism that an end to the pandemic may be in sight. Third, with fixed income returns near zero, the “fear of missing out” (FOMO) and “there is no alternative” (TINA) factors have driven investors disproportionately into the equity market. Fourth, economic data and corporate profits, though awful, have been better than many predicted and indicate that the trough may be behind us. Finally, the top five largest holdings in the S&P 500 all have legitimate fundamental tailwinds that have driven their prices higher. These stocks have pulled the broader market up along with them.

Given the challenges that remain, we are concerned about valuations. Although job losses have slowed to less than one million per week, the fact remains that over 10 million jobs have been lost since March. Some of these workers may be rehired in the near term, but many will not. Furthermore, despite the massive amount of fiscal stimulus already injected, many agree that more is needed to keep the economy afloat. The market is expecting a fifth coronavirus stimulus package to be passed, but Republicans and Democrats cannot seem to agree on the size and scope. The added agenda item of replacing late Supreme Court Justice Ruth Bader Ginsburg further dims the hope of passing a near-term stimulus bill. The November election could also bring volatility. Joe Biden was leading in the polls during the height of the pandemic, but President Trump has been gaining ground in more recent data. Regardless of who wins the election, we believe higher taxes are ahead, as the fiscal stimulus will need to be financed.

The talking heads debate the shape of the eventual economic recovery, whether V-shaped (a quick rebound), U shaped (a slower rebound), or W-shaped (an uneven rebound with multiple declines). We think the most likely scenario is a “K-shaped” recovery. In this scenario, white-collar workers who can work remotely will recover more quickly, while blue collar workers who are not able to return to work will continue to face a lingering decline. This will likely exacerbate the wealth inequality trends that have been building for the past 40 years. We also see a K shaped recovery forming in the equity markets, with growth and momentum stocks’ outperformance accelerating relative to value stocks’ performance. Early in the pandemic, we recognized the potential upside in growth stocks that would benefit from remote work trends, such as Apple (tkr: AAPL) and DocuSign (tkr: DOCU), while selling value stocks such as IBM (tkr: IBM) and Schlumberger (tkr: SLB). Now, we are focusing on taking money out of overbought positions in favor of undervalued companies that will weather the remaining stages of this pandemic.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.